Recent blog posts

-

The Self-Funded Searcher’s Guide: When a Fractional CTO Beats a Full-Time Hire

Self-funded searchers face specific constraints that change the decision framework—you’re capital-constrained (every dollar counts), operationally hands-on (you wear multiple hats), holding long-term (7-15+ years), and have technical knowledge gaps (most have business backgrounds). Your needs change dramatically across three phases: survival and stabilization (months 1-6, highest vulnerability), foundation building (months 7-12, strategic planning), and strategic…

-

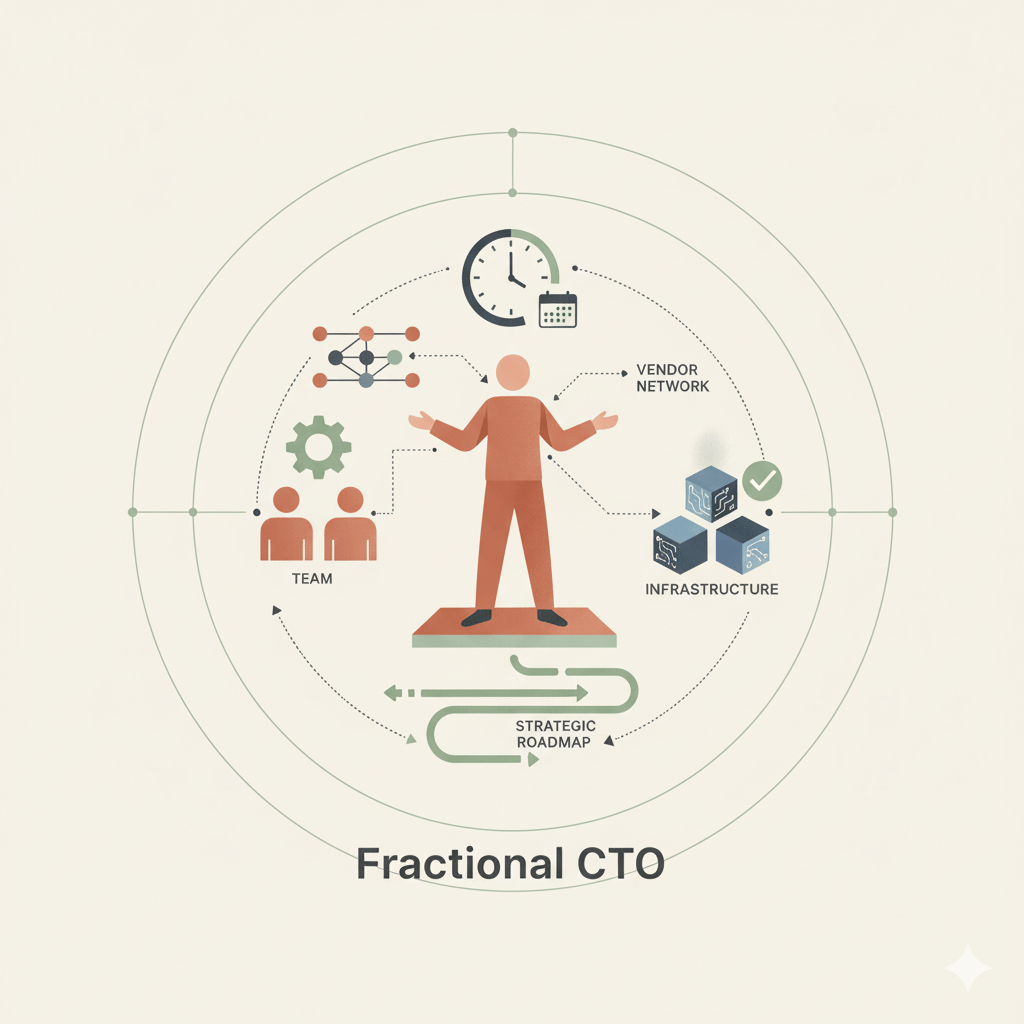

Why Fractional CTOs Are the Secret Weapon for Post-Acquisition Technology Transitions

Fractional CTO engagement delivers executive-level strategic technical leadership at one-third the cost of full-time hiring, with dramatically lower risk and greater flexibility. For $36,000-$120,000 in year one versus $320,000-$520,000 for full-time CTO (including recruiting, onboarding, and risk buffer), you get strategic technical assessment and prioritized roadmap, team leadership and capability development, vendor optimization, technical due…

-

Bridging the Gap: Translating Technical Findings for Non-Technical Searchers

Technical reports rarely answer the questions searchers need: Is this bad? Should I buy? Can I run it? Effective assessment separates technical evaluation from operational readiness. Five questions matter most: What technical tasks must I perform weekly? Who fixes problems? What knowledge leaves with the owner? Translation converts technical findings into actionable decisions and budgeted…

-

How Technical Dependencies Impact Post-Acquisition Transition Plans

Technical knowledge transfer is the #1 cause of ETA acquisition failures, driving 36% of negative returns. Standard 30-60 day transitions fail because critical operational knowledge remains undocumented. Realistic technical transition requires 12 months: pre-close documentation, supervised operations, independent operation with a safety net, and an emergency backstop. Proper planning costs $20,000-$50,000 but prevents $100,000-$400,000 failures.

-

Why Traditional IT Due Diligence Fails Lower Middle Market Acquisitions

Traditional technical due diligence was built for PE firms acquiring $100M+ companies—it assumes professional IT departments, significant technology budgets, and 3-5 year hold periods. Applied to lower middle market deals, it creates expensive noise instead of actionable insight. LMM technical assessment should start with operational questions (Can I operate this business post-acquisition?), distinguish “different from…

-

What Self-Funded Searchers Need to Know About Legacy System Risk

Legacy technology creates hidden acquisition risks. Five questions reveal whether old systems are stable-and-manageable or dangerous-and-fragile: When were systems last changed? What’s the downtime history? Who holds critical knowledge? Is platform support ending? What’s maintenance spending? Technical debt should influence valuation—estimate remediation costs and negotiate appropriate price reductions.

-

How AI Automation Changes Technical Due Diligence for Service-Based Businesses

AI and automation tools are democratizing technical due diligence for lower middle market deals. Automated analysis now handles 60-70% of traditional consultant work—security scanning, code quality, dependency checks—at a fraction of the cost. Five key metrics reveal 80% of technical risk, enabling self-funded searchers to conduct thorough assessments within tight budgets.

-

The AI Dependency Risk Your Searcher Clients Need to Understand

When acquisition targets depend heavily on AI tools for operations, searchers face unique risks. AI providers change pricing, capabilities, and policies with minimal notice. Five red flags signal danger: single-provider lock-in, undocumented workflows, revenue-critical AI dependencies, no usage monitoring, and untested alternatives. Proper AI integration requires guardrails, documentation, and contingency planning.